First Nations leaders in Ontario say Canada needs to fix what they call a “discriminatory” carbon price system, arguing the federal government failed to address their repeated concerns and blocked their exemption request only to then issue a carveout targeting Atlantic Canada.

A group representing 133 First Nations in the province filed an application for judicial review in Federal Court on Thursday, claiming the system places an unjust price on their communities without suitable cost relief.

A First Nation leader called the move “completely avoidable” if the federal government had only “showed up to the table.”

“We want climate action to be meaningful and have results, but not at the disadvantage of our communities, and that’s where the discriminatory comes in,” said Abram Benedict, Grand Chief of the Mohawk Council of Akwesasne, and head of the Chief of Ontario’s environmental portfolio.

The application asks the court to order the government to negotiate with the Chiefs of Ontario for a solution that upholds the carbon price’s purpose to “alleviate the climate crisis” without worsening the “human rights crisis” experienced by First Nations.

Alternatively, the group wants the court to issue an interim exemption and order the government to develop a carveout with First Nations that addresses their concerns.

“As Canada knows, this regime is grossly unjust to First Nations and their members,” the document said.

The judicial review application has not been tested in court.

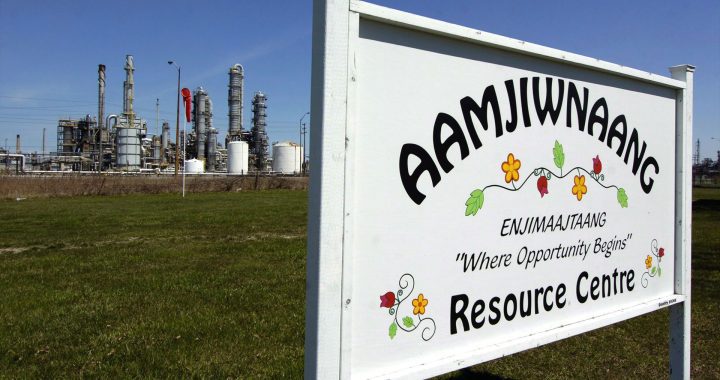

The Chiefs of Ontario said northern and remote First Nations have limited means to transition to greener energy alternatives and already face higher energy costs. The court application said those costs can be linked to colonization, for example through inadequate, energy inefficient housing.

The group also argues that many of its members, who live and work on reserve and don’t use the federal income tax system, don’t have ready access to Ottawa’s carbon price income-tax rebate.

“Our people are immensely impacted by this,” Benedict said in an interview.

First Nations leaders were taken aback by the federal government’s move last month to exempt home heating oil, which is most common in Atlantic Canada, from the carbon price after the group’s own exemption requests were shot down, Benedict said.

“That exemption,” Benedict said, “it really shone more on how we’re being affected by this and how there are solutions that the federal government can do for regions or for First Nations communities and is not prepared to do it.”

Prime Minister Justin Trudeau announced last month the government was temporarily exempting home heating oil from the carbon price because it was more expensive than natural gas and a greater proportion of people who use it have no other option.

His critics cried foul, labelling the move as regional favoritism to shore up support in Atlantic Canada given declining poll numbers.

The Conservative opposition jumped on Thursday’s judicial review application to advance its calls to “axe the tax”. In a statement, the party suggested the Chiefs of Ontario had to take the government to court because the communities they represent don’t “fit into the Liberal’s political math.”

Asked Thursday whether the government would create an exemption or boost rebates for First Nations, Trudeau said the government would continue to work with “Indigenous communities on affordability, on supports, and on the fight against climate change.”

“We’re walking the road of reconciliation because we know how important it is to support Indigenous peoples as they build the strong, thriving communities,” he said.

The federal government’s carbon price was first applied in 2019, requiring all provinces and territories to either have their own equivalent price or use Ottawa’s. The idea underlying the fuel charge is that increasing the cost of fossil fuels will incentivize Canadians to seek out alternatives.

The government said the program is revenue-neutral, returning 90 per cent of the proceeds to households through an income-tax rebate. The other 10 per cent is used to fund programs that help, among others, Indigenous communities reduce their fuel consumption and to top-up rebates for rural residents.

The Chiefs of Ontario said it has come up with solutions to improve the system, including what Thursday’s court application called an “alternative rebate regime.”

Under that proposed regime, it said First Nations in Ontario would see a current group rebate boosted to two per cent of all proceeds collected in Ontario, up from the current 0.7 per cent.

It also called for a more accessible avenue for First Nations members to get the rebate other than the federal income tax, such as by having First Nations administrators pay the rebate to their members.

“We have pushed hard politically to find a solution,” Benedict said. “Thus far, the response has been, no, sorry, this is what’s available.”

Story by Jordan Omstead.